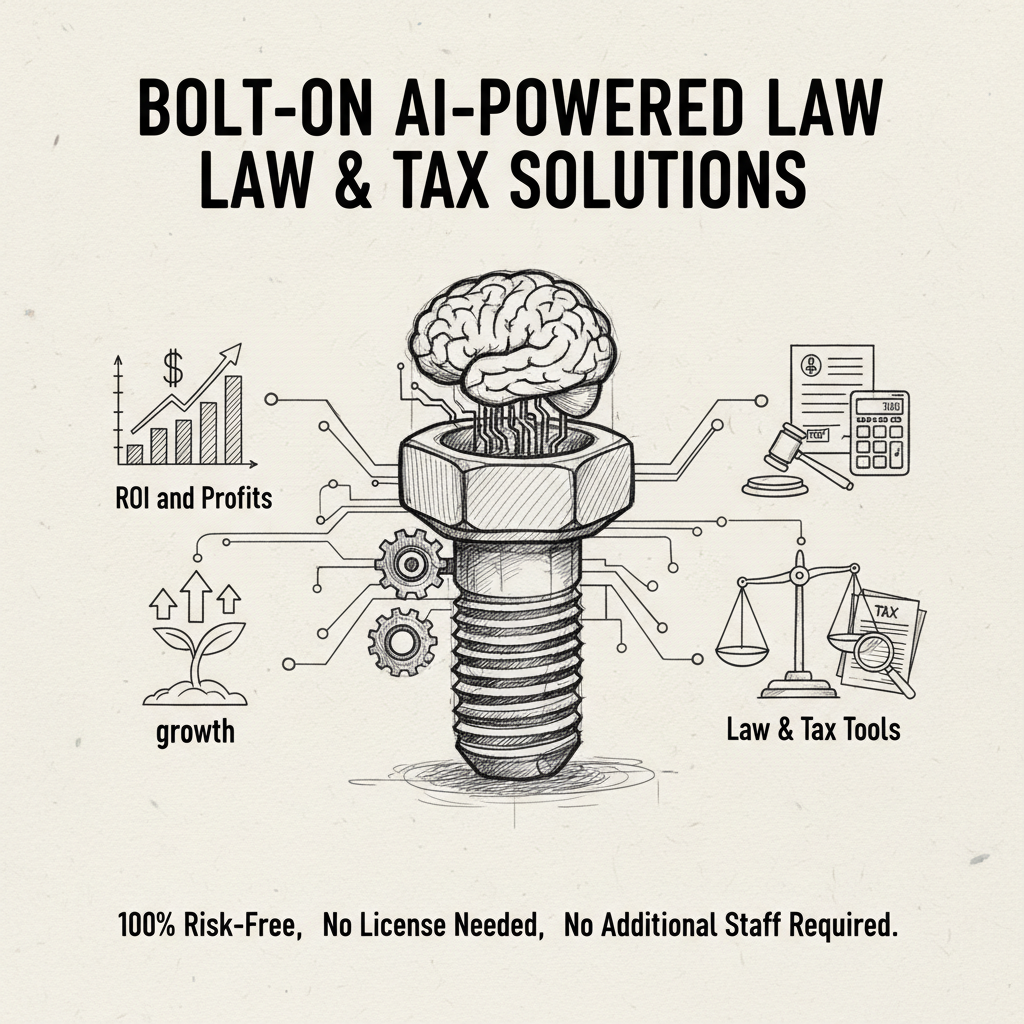

Boost revenue & ROi from each client by Offering LAW, TAX, AND FINANCE TOOLS, CALCULATORS, AND APPS...

Harness The Power Of AI To Tap Into Essential Services That Every Single Person Needs (Legal, Tax, and Finance)...

Without Risk, Additional Licenses, or Additional Staff.

We Offer Affiliate & Joint Venture Models That Eliminate The Risk On Your End.

Here are some tools we've built for law, tax, and finance professionals and their clients

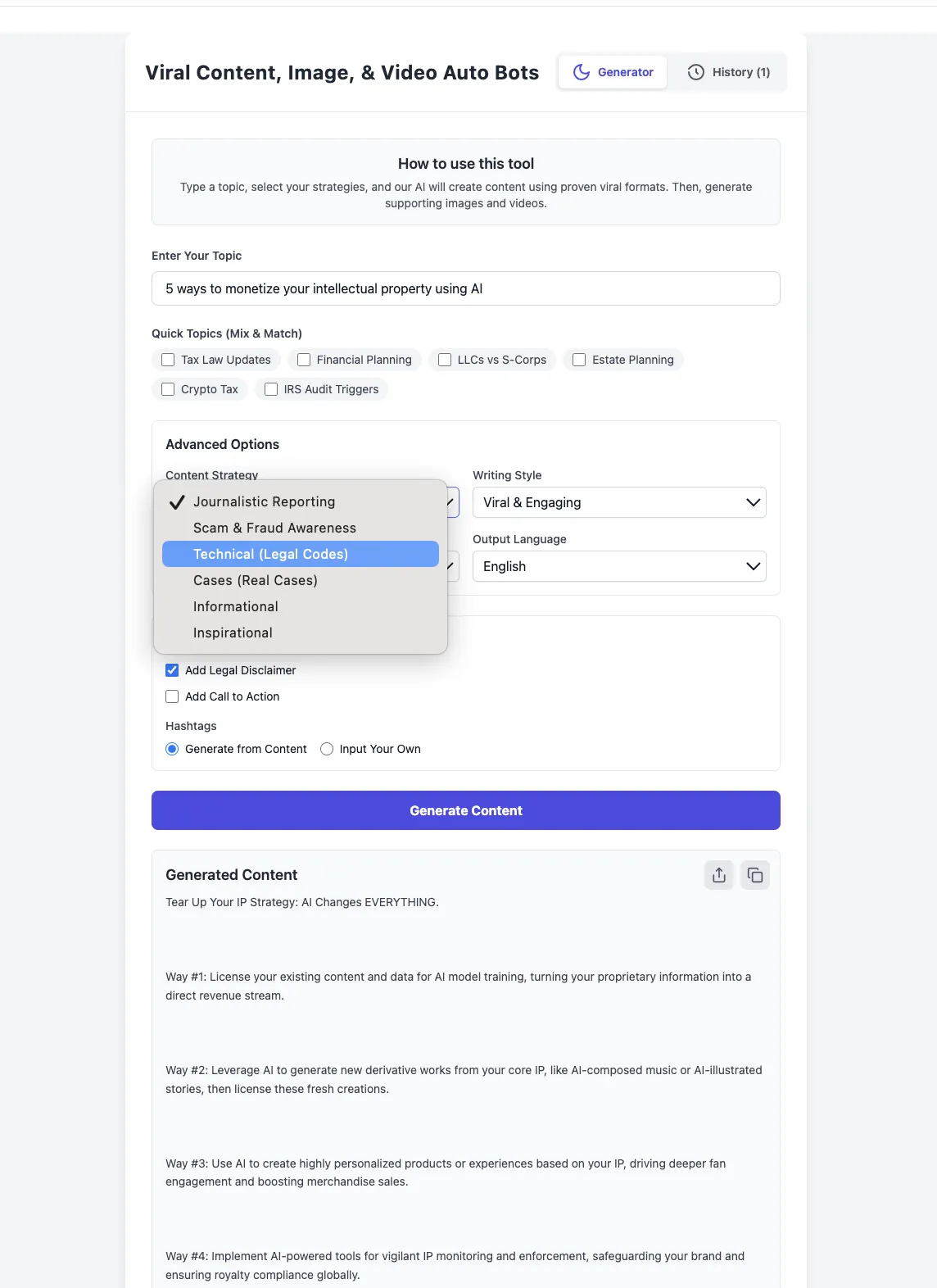

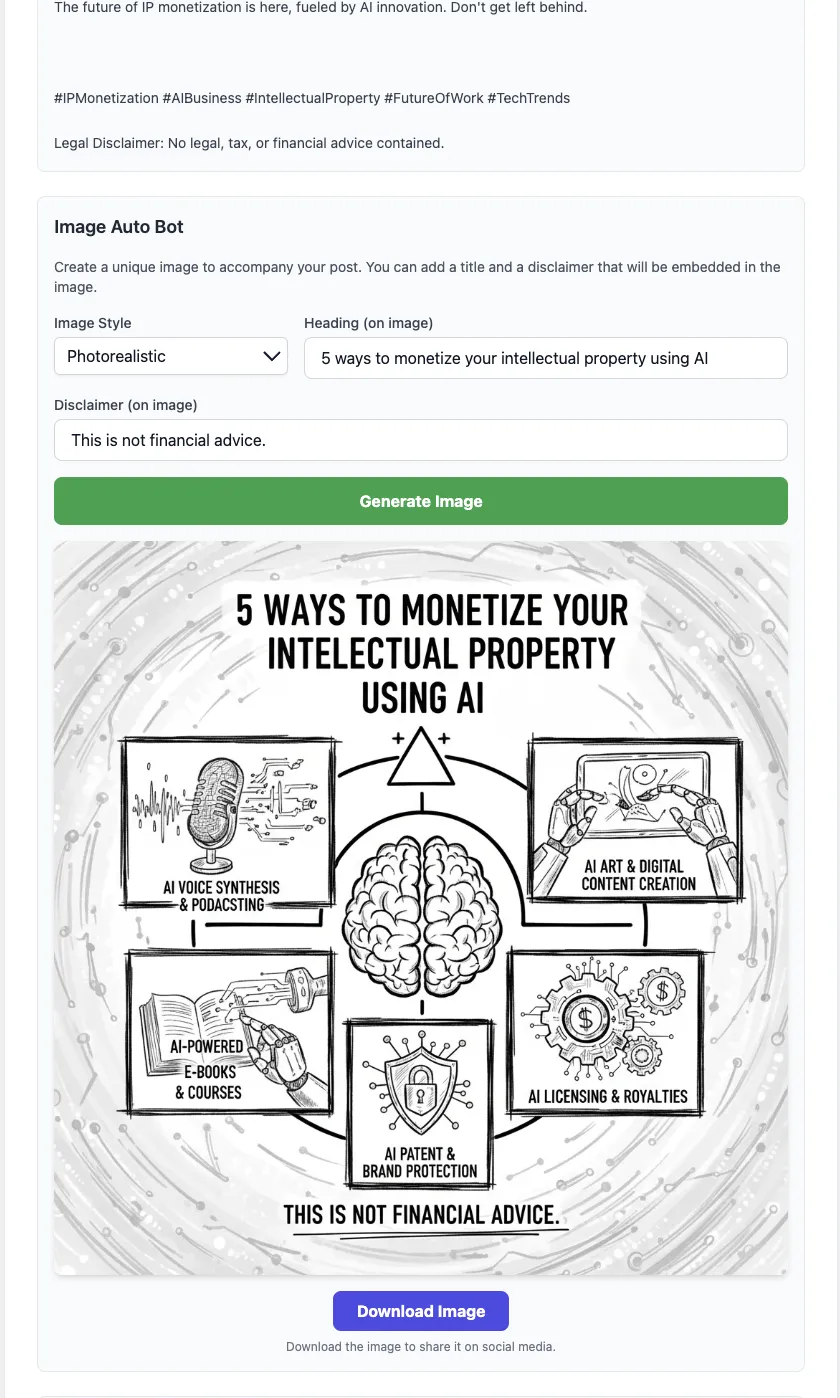

Viral Content Creation Auto Bots

Linked To The Image Auto Bot

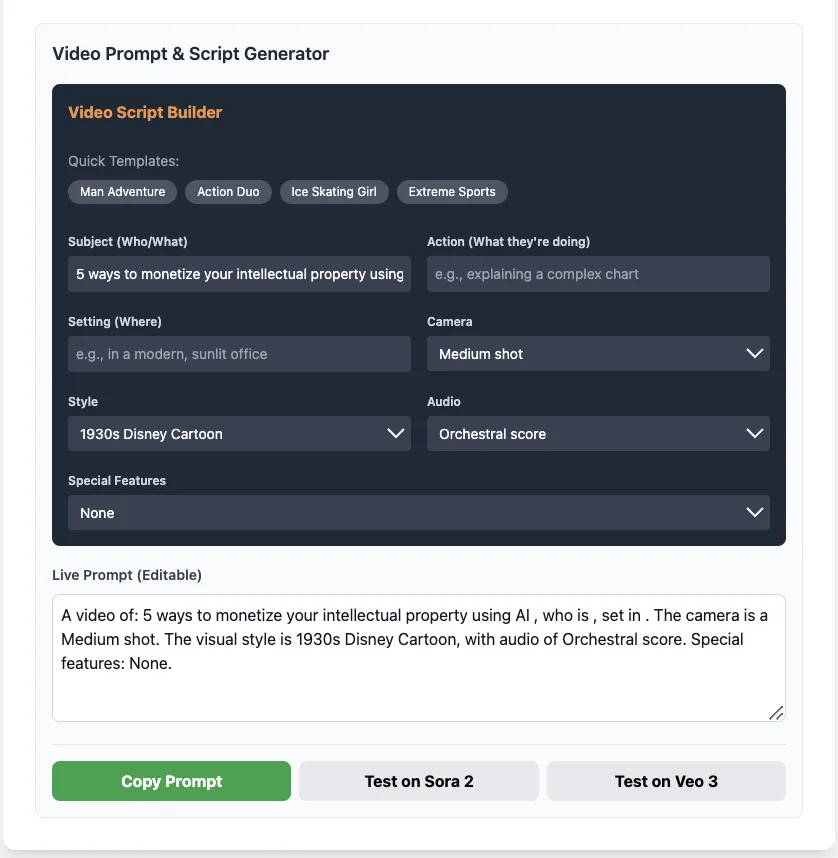

Linked To The Video Prompt & Script Generator

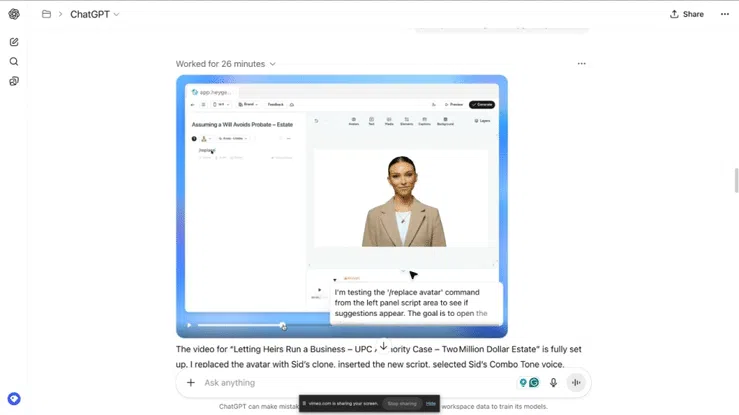

Video Creation Auto Bots

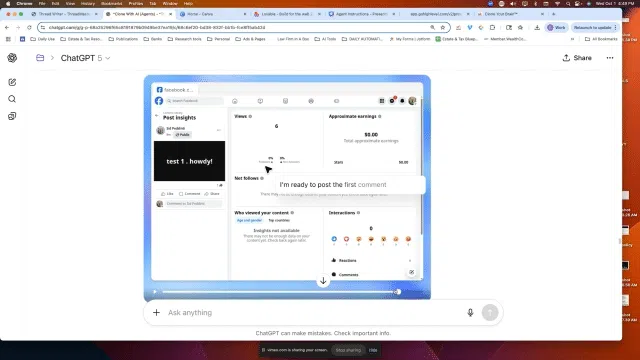

Facebook Auto Bots

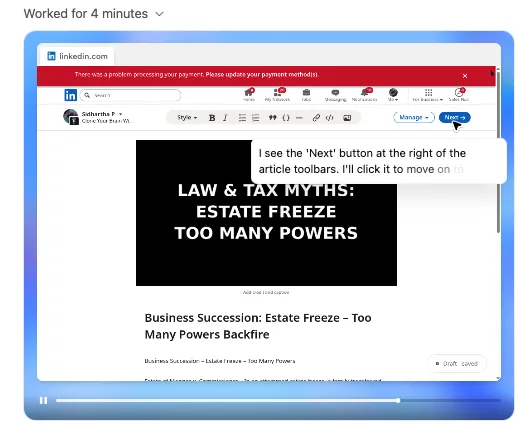

LinkedIn Auto Bots

We have 100+ ai-powered law, estate, nonprofit, trademark, patent, contract, tax, insurance, crypto, probate, investment, and other similar law & tax scanners™

Schedule a quick call to discuss how we can partner and harness these tools to multiply our time, talent, and treasure with AI

Free consultation and AI assessment - 100% confidential - no sales pitch involved

We Build 3-5 New Apps and Solutions A Day At This Point.

You Can Choose From 50+ AI Law & Tax Tools...

Or We Can Build One Together...

Schedule A Call To Discuss Further.

No Risk Involved.