Law Firm In A Box:

Where 1 + 1 = 11

A Strategic Invitation for Lawyers Ready to Do More - Together

What If the Most Valuable Legal Insights and Services You Could Offer…

Most industries collaborate.

Business coaches. Marketing experts. Medical professionals. Even financial advisors.

But lawyers?

We’re still trying to build everything on our own.

Run the firm alone

Invest in marketing & ads alone

Explore new areas of law alone

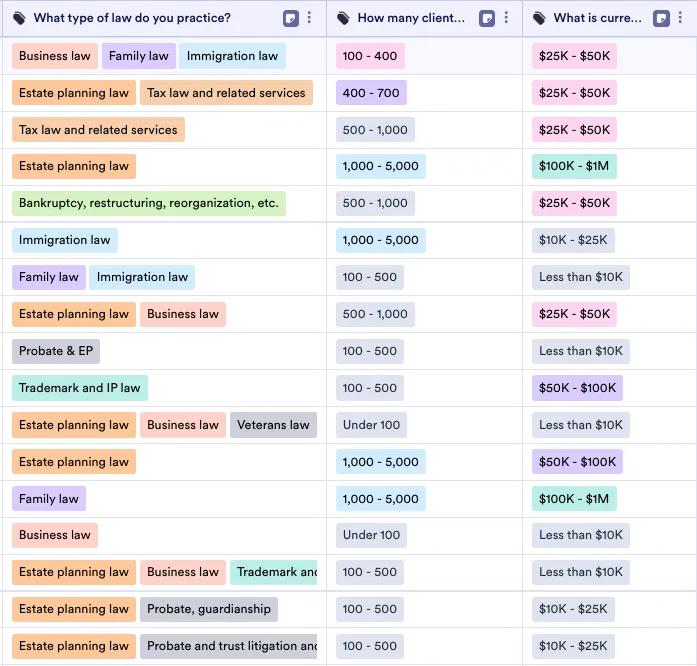

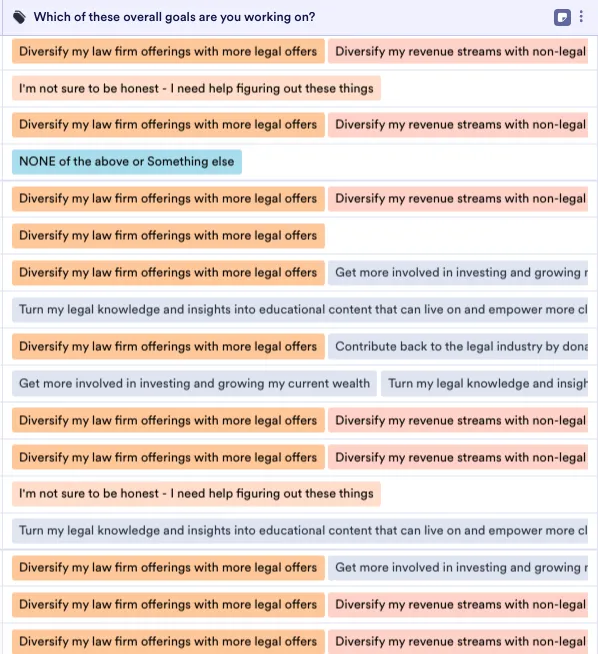

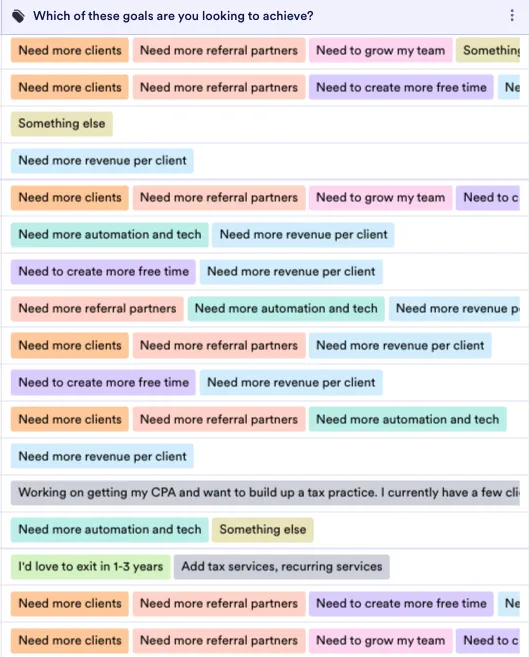

Here are some statistics from a few surveys I have conducted with law firm owners in various Facebook and LinkedIn Lawyer Groups... the same ones where we connected from...

The Inner Workings of a Modern Law Firm: Marketers Lie, Numbers Don’t

You’ve seen the flashy ads:

Scale to 7 figures in 6 months

Build a firm that runs itself - no lawyers needed

Implement this one funnel for unlimited leads

Implement this one AI prompt or AI salesperson

But here’s what the numbers say:

Most firms are stuck between $25K–$50K/month.

Operating costs and taxes eat half. Personal expenses eat the rest.

What’s left? Maybe $5K–$10K in true monthly growth.

That’s not scaling. That’s surviving.

The real fix isn’t a funnel—it’s a framework:

📉 Lower taxes.

💼 Higher revenue per client.

🛡️ Smarter legal structures.

🔁 Recurring revenue.

Marketers sell the dream.

Lawyers live the math.

Press Play To Watch The Video

Other Platforms And Media Outlets Where Sid Peddinti™ Shares His Insights, Research, and Philosophies

To Make It Very Simple:

Become A Philanthropist™ And Build A Thriving Law Firm By Helping Others Become Philanthropists As Well

There are only a handful of legal strategies that lawyers can actually leverage themselves and offer it as a service to their clients: BENT Law™ (Business, Estate, Nonprofit, and Tax Law) Are Four Intertwined Areas That Fall Into The Few That You Can Leverage Yourself & Offer To Clients As Well.

The Benefits And Advantages Of Leveraging These Philanthropic Tax Strategies

LEVERAGE THESE TAX STRATEGIES IN YOUR BUSINESS AND IN YOUR PERSONAL LIFE

Use it for Yourself:

☐ Reduce your taxes (30-60%) every year - potentially for the rest of your life

☐ Advertise for free, with grants & donations from the world's largest corporations

☐ Stand out as an educator, philanthropist, and impact investor - not just an attorney

☐ Build goodwill, credibility, and public trust through your philanthropic and pro bono work

☐ Operate with the structure and clarity of a Mini Family Office™ - the big picture in mind

☐ Bridge "law, tax, and finance" gaps in your business and estate plans - even lawyers are impacted

☐ Create a legacy vehicle that protects wealth and carries your values forward - protect it from all sides

☐ Lower student loan payments by hitting certain criteria through your nonprofit - check the PSLF website

☐ Teach the law, empower people, fight for justice, and conduct 50 hours of pro bono work (especially if you check the box that you are doing so)

☐ Think about that last one again: It's about self-respect, integrity, and doing the right thing - Have you ACTUALLY donated 50 or more hours worth of pro bono work to teach the law, educate people, and improve society with your knowledge and insights every single year OR is that a box that you check every year knowing it's not true!

In short - leverage the power of the tax code to Become A Philanthropist™ and unlock an ocean of financial and non-financial benefits that are benefit you, benefit your family, benefit your business, and benefit society - simultaneously.

OFFER THESE BOUTIQUE LEGAL & TAX STRATEGIES TO EXISTING OR NEW CLIENTS

Offer it to Your Clients:

☐ Partner with us to offer these advanced legal and tax restructuring services to your clients: Old ones, current ones, and new ones

☐ Transcend beyond billable hours and enter the world of premium legal consulting with the Mini Family Office™ model - working and representing multi-millionaires with large tax and estate obligations and need us to help them

☐ Help clients create public nonprofits, private foundations, and tax-advantaged investment portfolios that collectively shift tens of millions in "pre-tax" income into socially conscious investments and grants - become the "change maker"

☐ Add a "virtual, lucrative, and flexible" high-end revenue stream to your practice with offerings that typically range from $20,000 – $100,000+ per case.

☐ Build your brand as a forward-thinking attorney that's advancing the law, conducting pro bono work, empowering nonprofits and philanthropists - not a form-filling, run-of-the-mill, law firm owner that's only focused on sales.

We are in the midst of the Great Wealth Transfer - a shift in wealth from one generation to the other - expected to last roughly 20-40 years. The number of people who are worth $1 million (total net worth) is in the TENS OF MILLIONS - and there are only a handful of firms in the entire country who are serving clients with these "legal and tax strategies" - and we are one of them, but we've hit a limit on how many people we can serve.

Join me to fill that gap with Law Firm In A Box™.

The Philanthropic Structures We Build for You And Your Clients

THE PUBLIC NONPROFIT - EDUCATION, INNOVATION, AND RESEARCH

☑ Unlock $120,000/year in free Google Ads to promote your insights, courses, blogs, workshops, webinars, surveys, or podcasts.

☑ Attract media attention, partnerships, and press by leading as a nonprofit educator, not just another law firm.

☑ Publish original research, whitepapers, and legal tools under a 501(c)(3), positioning yourself as a credible legal scholar and industry voice.

☑ Host weekly pro bono Q&A sessions or legal hotlines to serve the public and log your state bar-required pro bono hours - while building unmatched goodwill.

☑ Leverage nonprofit status to tap into billions in corporate, foundation, and government funding, including Amazon, Tesla, Meta, Ford Foundation, and more.

☑ Create and syndicate high-authority content on law-adjacent topics - real estate, taxes, investing, asset protection, and family business transitions.

☑ Form educational partnerships with CPAs, realtors, financial advisors, or physicians — co-create content and become the “hub” for multi-disciplinary referrals.

☑ Establish yourself as The Legal Watchdog™ in your region - a guardian of truth, protector of the public, and advocate against legal misinformation and online fraud.

☑ Build a nonprofit legacy that survives you - your IP, videos, courses, and curriculum can continue educating others long after you’re gone.

☑ Operate with integrity and vision while shifting your brand positioning from “law firm owner” to educator, trainer, and contributor to the public good.

THE PRIVATE FOUNDATION - TAX SAVINGS, WALTH PROTECTION, AND IMPACT INVESTING

A Tax-Exempt, Legacy-Building Wealth Strategy for Yourself or Your Clients:

☑ Redirect 30-60% of tax liability into a charitable foundation you and your family legally control.

☑ Deduct up to 30% of AGI for appreciated assets (stocks, crypto, real estate, collectibles, businesses, IP) donated to your private foundation.

☑ Eliminate capital gains taxes by contributing appreciated assets before liquidation.

☑ Avoid gift and estate taxes by using the foundation as a legal bypass - and preserve wealth intergenerationally.

☑ Maintain strategic control through board governance, family-led missions, and carefully drafted bylaws.

☑ Use the foundation to fund scholarships, grants, charitable missions, research, and more — all while staying in compliance.

☑ Shield assets from lawsuits and estate court fights - foundation-held assets are not subject to probate or contested wills.

☑ Build family purpose alongside wealth, keeping your children, legacy, and values aligned.

☑ Gain reputational leverage by being the “philanthropic force” behind local causes, institutions, or innovations — as a donor, grantor, and benefactor.

☑ Position your brand alongside the elite - Gates Foundation, Ford Foundation, Chan Zuckerberg Initiative, and others — who legally reduce taxes while driving global impact.

☑ Offer this strategy to your clients and add a $20,000–$100,000 premium consulting channel to your firm — all while creating legacy, not just transactions.

The Power Is in the Pairing

One nonprofit earns you trust.

One foundation earns you tax breaks.

Together, they give you the rarest leverage in law:

Legal authority

Public credibility

Institutional control

Tax-free visibility

Legacy beyond your lifetime

This is not a gimmick. This is the tax code.

Used wisely. Used ethically. Used by billionaires.

Now available for mission-driven lawyers, law firm owners, and their clients.

Cost & Pricing Philosophy

The questions you might be considering:

How Much Does It Cost = generally nothing.

What's the ROI of this pathway = infinite potential.

HOW? Here's The "Tax Lawyer" Answer and Explanation, and it's not "It Depends".

We look at the "person" we are serving, and the "line items" that translate our work into numbers:

THE PERSON (aka Clients and Customers):

The IRC (internal revenue code) defines a person as an individual, corporation, partnership, association, trust, or estate.

In the Mini Family Office™ BENT Law™ approach, we are creating and forming a combination of all these entities for different purposes - which means we can serve multiple persons (taxable and tax-exempt entities) in a representation.

More persons we serve, more "line items" available to capture our work and services.

THE LINE ITEMS (aka Making It A No-Brainer):

What line items capture our work as full line item deductions - think ordinary and necessary expenses.

What strategies allow your clients to recapture or reclaim the full value of our services - think tax reduction.

What programs can directly offset the investment required to pursue these avenues - think grants & donations.

What is the additional boost in value (business or personal) - now and in the future - that our work can provide?

What is the value of building a platform to teach the law, leverage the branding, unearth new opportunities, transcend from billable hours to creating industry-shaping movements?

And even the personal satisfaction of doing charitable work, philanthropic work, and empowering others?

The cost of implementation is:

Absorbed through IRS-permitted deductions (redirecting "Otherwise Taxable Dollars")

Recovered through tax savings and refunds

Offset by restructured marketing expenses

Funded by grants, refunds, and redirecting existing spend

Treated as a professional service expense under business or nonprofit budgeting

We practice what we preach — and we show you how to do the same for your clients.

This approach allows you to offer more value to your clients, increase the billing amount, and earn more per case - in addition to retaining clients for a longer period of time since you have a lot more to offer than one service (example: a trademark filing). The same clients need other services as well - and will be purchasing those services from other providers. Keep customers under your roof by sealing the gaps with nonprofit and tax law services.

Leverage Both Sides Of The Tax Code & Help Your Clients Do The Same

Offer Boutique Tax & Nonprofit Solutions To High-Income Earners And Multi-Millionaires Who Are Looking For People Like Us. We create joint ventures with law, tax, and financial professionals looking to boost revenue, attract high-net-worth clients, and offer a range of highly impactful and powerful strategies that are over 100 years old and used by virtually every billionaire and wealthy family - that's where we found a lot of these "secrets" that are hidden in plain sight

Recapture Missed Revenue From Cases

Offer nonprofit and foundation work to your network of followers, cold leads, and even old clients in your database - recapturing missed revenue.

You already have the "marketplace" of buyers.

Boost Earnings & Profits Per Case

Imagine adding another $5,000, $15,000, or $40,000 per customer - old customers and new ones, boosting your overall "earnings per deal".

Start by offering this to your old clients - $0 required!

Increase Value & Bridge "Hidden" Gaps

Boost value to clients by offering nonprofits and foundations, especially from as a business expansion, estate protection, or tax reduction tool.

Offer a strategic perspective that others have overlooked.

Expand Vertically Or Horizontally

Leverage the power of the tax code to pierce and penetrate the market in a completely different way, allowing expansion in diverse ways.

The flexibility of the tax code allows you to diversfy.

Offer Legal Consulting Work That Is Flexible

Nonprofit, foundation, and tax consulting is very flexible and can be applied to hundreds of different scenarios - perhaps even thousands.

Consulting work is quite different from law firm work.

Build New Referral Streams With Others

Bypass some of the traditional partnership, solicitation, and referral restrictions on your law firm by adding a nonprofit arm or a consulting firm to the mix.

Start a legal education nonprofit and form JVs.

Gain Goodwill, Trust, And Loyalty

Stand out as a lawyer and law firm that serves society and advances humanity, not just focused on closing deals, billing hours, and profits.

Operating or serving nonprofits is noble and respectable work.

Leverage Foundations For Tax Savings

Private foundations are one of the most powerful vehicles in the tax code that offer layers and layers and layers of tax benefits.

Structuring a foundation can unlock a whole new market.

Attorney, Educator, & Philanthropist

Stand-out in your marketplace as an innovator, educator, impact investor, purpose-driven leader, and philanthropist + Attorney.

How many of your competitors are leveraging this angle?

Apply below TO EXPLORE LAW FIRM IN A BOX

Become A Double Bottom-Line Law Firm

Explore The Power Of Nonprofits And Foundations™

Good For Business, Good For Society™

Schedule A Chat With Sid Peddinti™